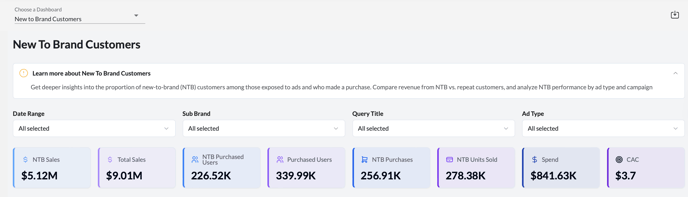

New To Brand Customers

Learn more about the New To Brand Customers query and how to leverage it through Intentwise Explore (AMC).

New-to-Brand Customers

The New-to-Brand Customers dashboard helps you measure how effectively your campaigns are acquiring first-time customers. It provides both high-level KPIs and detailed campaign and ad type breakdowns, so you can see where your NTB sales are coming from and how cost-efficiently you’re driving new users.

This query attributes performance to new-to-brand (NTB) shoppers, i.e., users who purchased from your brand for the first time within the 12-month lookback window.

Dashboard Overview

At the top of the dashboard, you’ll find key metrics:

-

NTB Sales ($5.12M) – Revenue from first-time customers.

-

Total Sales ($9.01M) – All revenue (NTB + repeat).

-

NTB Purchased Users (226.5K) – Unique first-time buyers.

-

Purchased Users (339.9K) – All unique buyers.

-

NTB Purchases (256.9K) – Total purchase events from NTB users.

-

NTB Units Sold (278.4K) – Number of units sold to NTB users.

-

Spend ($841.6K) – Advertising investment.

-

CAC ($3.70) – Average customer acquisition cost.

This overview helps you quickly gauge the share of sales and customers coming from new buyers.

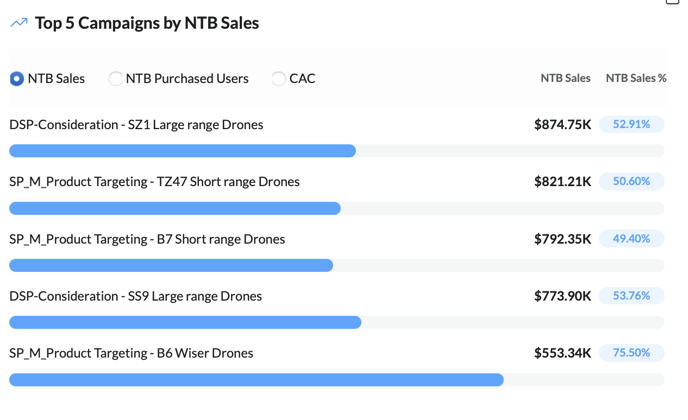

Top 5 Campaigns by NTB Sales

This section highlights the campaigns contributing the most to NTB sales.

For example:

-

DSP – Consideration (SZ1 Large Range Drones) delivered $874.7K NTB Sales, accounting for 52.9% of its sales.

-

SP – Product Targeting (TZ47 Short Range Drones) contributed $821.2K NTB Sales, with 50.6% NTB share.

-

SP – Product Targeting (B6 Wiser Drones) drove $553.3K NTB Sales, with a very high NTB share (75.5%).

This ranking makes it easy to spot campaigns that are strongest in new customer acquisition.

Performance by Ad Type

The bar chart breaks down NTB vs. Repeat users by ad type:

-

Sponsored Products show the highest NTB volume (over 100K NTB users).

-

DSP also contributes strongly, balancing both NTB and repeat buyers.

-

Sponsored Display has a relatively higher NTB ratio than repeat.

-

Sponsored Brands show smaller NTB contribution compared to other ad types.

This view allows you to compare how different ad types perform in acquiring new customers.

Ad Product Performance Table

This section provides detailed NTB metrics by ad type:

-

Sponsored Products – $2.51M NTB Sales, 108K NTB users, ~56% NTB share.

-

DSP – $1.71M NTB Sales, 76K NTB users, ~53% NTB share.

-

Sponsored Display – $788.7K NTB Sales, 36K NTB users, ~67% NTB share.

-

Sponsored Brands – $111K NTB Sales, 5.5K NTB users, ~39% NTB share.

This makes it clear which ad types are most efficient for NTB acquisition.

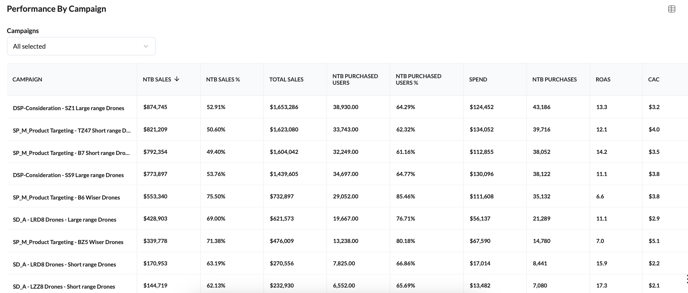

Performance by Campaign Table

The campaign-level view provides granular details for each campaign:

-

Metrics available: NTB Sales, NTB Sales %, Total Sales, NTB Purchased Users, NTB Purchased Users %, Spend, NTB Purchases, ROAS, CAC.

-

Example:

-

DSP SZ1 Large Range Drones → $874.7K NTB Sales, 52.9% NTB Sales %, ROAS of 13.3, CAC of $3.2.

-

SP TZ47 Short Range Drones → $821.2K NTB Sales, 50.6% NTB share, ROAS of 12.1, CAC of $4.0.

-

SP B6 Wiser Drones → $553.3K NTB Sales, very high NTB share (75.5%), ROAS of 6.6.

-

This table is essential for identifying campaigns with the best balance of NTB volume, efficiency, and cost per acquisition.

How it works

-

Navigate to Intentwise Explore

-

Go to Queries > Query Library

-

Search for and add "New To Brand Customers" to your saved queries

-

Fill in the required parameters and run the query (see this article for detailed settings)

-

Once executed, access the results under the Insights section for product-level metrics and visualizations.

For more information, refer to our data model.

Key Use Cases

-

Measure brand acquisition: Identify how many customers are new vs. repeat.

-

Optimize spend efficiency: Track CAC and ROAS at the campaign level.

-

Compare ad types: See whether DSP, Sponsored Products, or Display performs better for NTB acquisition.

-

Spot high-NTB campaigns: Double down on campaigns with strong NTB shares (e.g., >70%).

-

Balance NTB vs. repeat: Adjust strategy to ensure both customer growth and retention.

Recommendations

-

Prioritize campaigns with high NTB share. Campaigns like SP B6 Wiser Drones (75% NTB) in our example show outsized acquisition efficiency.

-

Balance NTB volume with CAC. A campaign may drive high NTB sales but at a higher acquisition cost—track both.

-

Test across ad types. Sponsored Products may dominate NTB volume, but Display and DSP often bring higher NTB percentages.

-

Monitor long-term ROI. NTB customers often have higher lifetime value—optimize campaigns that build this base.

Frequently Asked Questions (FAQs)

What are instructional queries?

Amazon Marketing Cloud's (AMC) instructional queries provide pre-written SQL code that AMC users can use as is or modify for common measurement and analytics tasks.

What defines a “New-to-Brand” customer?

A shopper who purchased from your brand for the first time in the past 12 months.

Are repeat customers included?

Yes, but repeat sales are shown separately, so you can compare NTB vs. existing buyers.

Can I view NTB metrics by both ad type and campaign?

Yes. The dashboard provides both campaign-level and ad type-level breakdowns.